DeFi was built to remove intermediaries, but DeFi risk did not disappear with them. Many teams understand that DeFi is risky. However, they find it hard to pinpoint where the real danger begins.

The issue worsens as assets move quickly across chains and protocols. A single exploit can spread risk across the entire ecosystem in minutes. The answer isn't just copying traditional finance.

To manage DeFi risk, you need real-time compliance and on-chain visibility. These features should fit decentralized systems. As DeFi matures, risk is no longer an edge case. Forward-thinking platforms embed risk management into their daily operations. Platforms that overlook this reality usually respond only after losses happen. By then, they have already harmed users, liquidity, and their reputation.

Why Systemic Risk is the Biggest Threat to Your Protocol

DeFi is not just a small test anymore. Big exchanges and lending apps move billions of dollars every day. More money means hackers want to steal more. This makes DeFi risk a moving target.

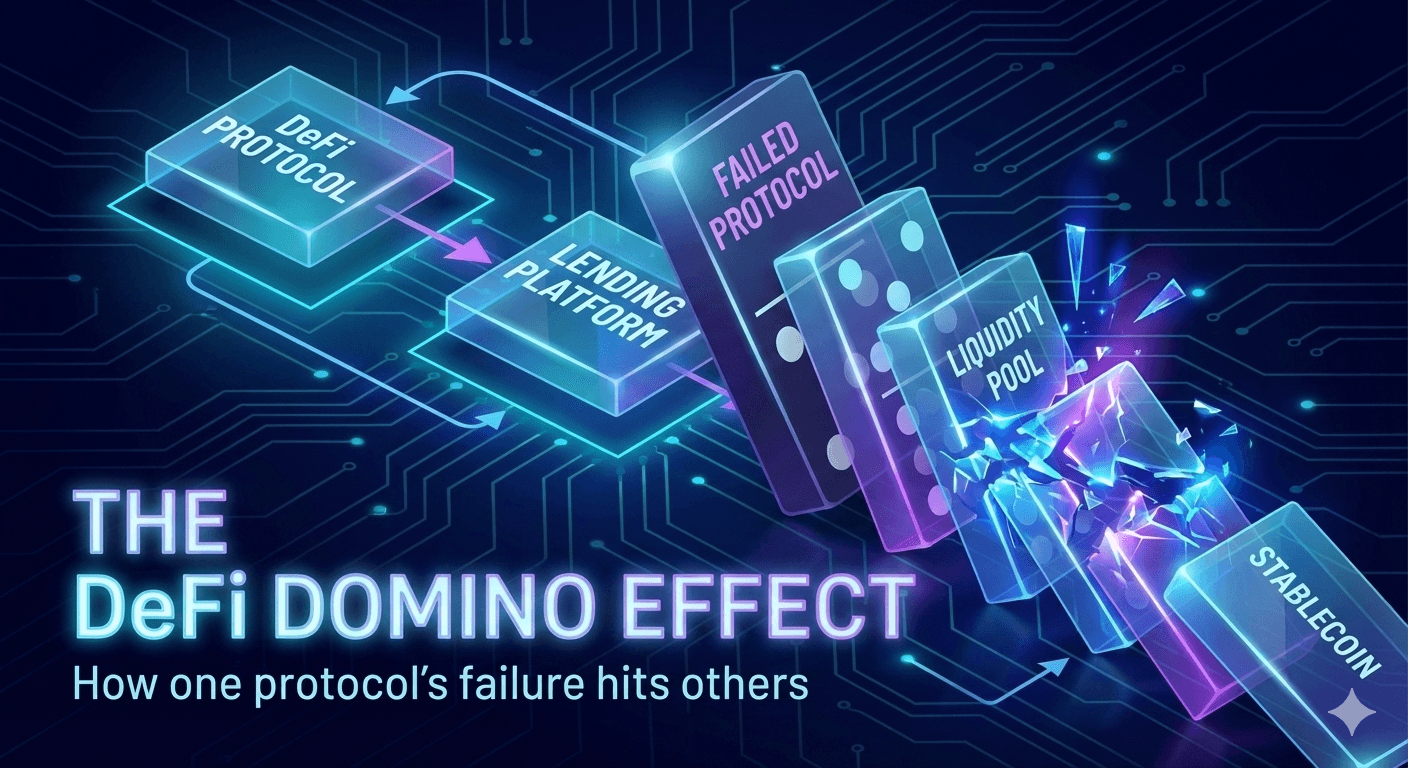

Your project is part of a huge web. Everything is connected. You might think your code is perfect. You might have checked it many times. But in DeFi, you are only as strong as the weakest link you touch. A single mistake can travel through the system like a virus. One broken protocol can hurt dozens of others that use it for money or yield.

We often call this DeFi Lego. We can build complex tools fast by stacking projects together. But this is also a big weakness. If one Lego block breaks, every project built on top of it is in danger. This is true even if your own code is totally safe. You get the risk from every project you touch.

Think about the bridges you use. If a bridge gets hacked, your users can lose money. If a stablecoin you use loses its value, your money can disappear in an hour. This is systemic risk. It means one failure can crash the whole system. We have seen this happen many times. It makes people trust blockchains less. If we want billions of people to use these tools, we must work together to make them safer. You need to know exactly what is happening in the projects you use at all times.

Beyond Code: Smart Contract Logic and the Speed of On-Chain Exploits

Smart Contract Logic as a Primary Danger

Smart contracts are the base of DeFi. They run money rules and control assets. If something goes wrong, you cannot undo it. Most DeFi risks in smart contracts come from logic flaws. These are not simple coding mistakes.

Logic flaws happen when the code does what it is told, but the developer did not think about all the results. These risks often show up with flash loans, oracle problems, and governance attacks. Attackers do not always need to break your code. They find weak spots in your economic setup.

For example, attackers use flash loans to change an asset's price on one exchange. This tricks an oracle into giving a wrong price to a lending app. The attacker then uses that wrong price to steal money. This happens very fast. You need tools that work faster than humans to catch these economic security risks.

Tracking Stolen Assets Across the Chain

Once a hack happens, the stolen assets do not stay still for long. They are swapped for stablecoins or bridged to other chains immediately. This creates a huge problem for the rest of the ecosystem. Any platform that later touches those funds is now at risk. Real-world cases, like the Balancer V2 exploit, show how fast risk can spread on-chain. If you are a protocol owner, you do not want these stolen funds in your pools. If you have them, you are looking at serious DeFi risk. You might get flagged for money laundering even if you did nothing wrong.

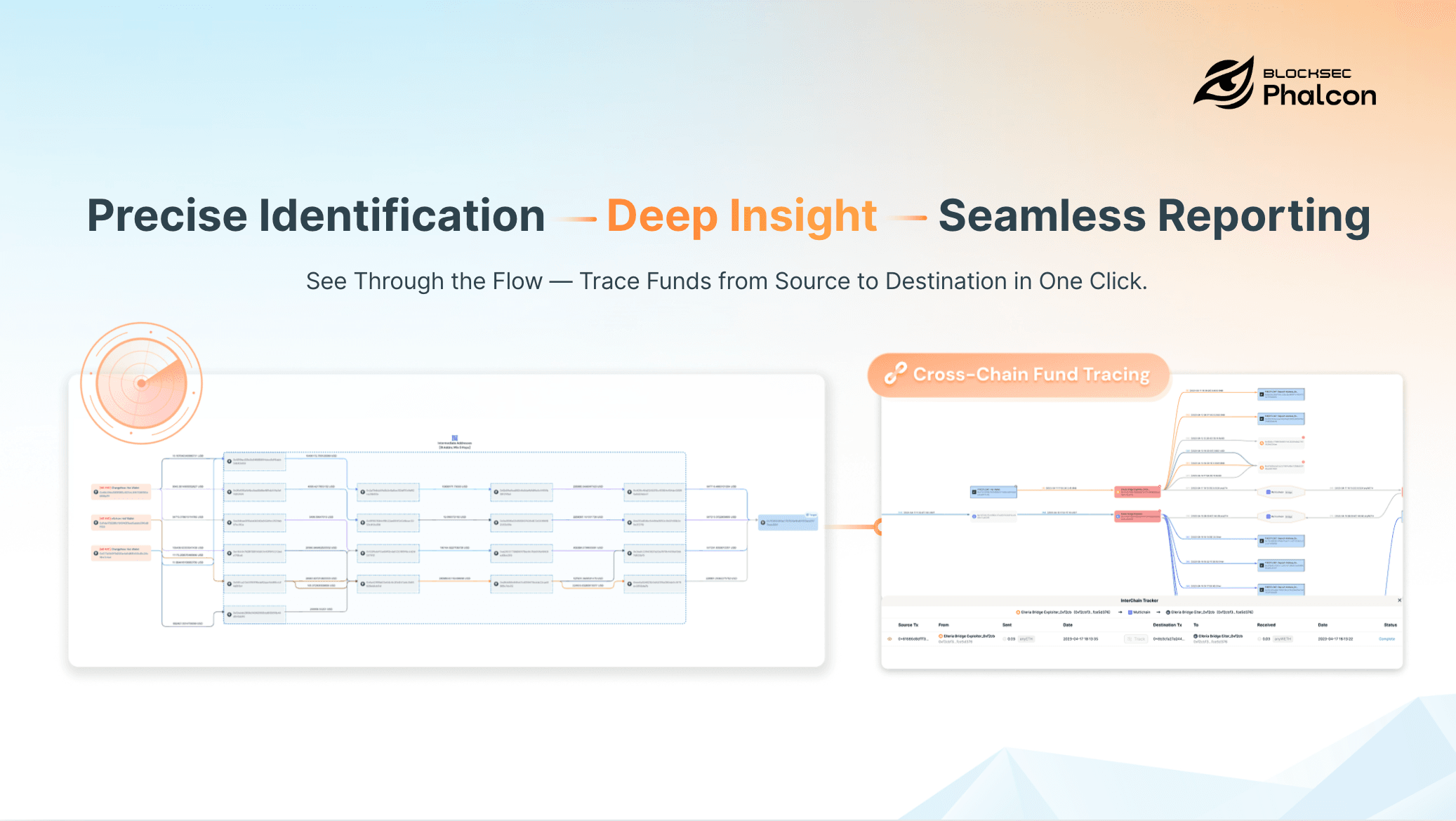

Blockchain tools, such as Phalcon Compliance, help you track these fund flows in real time. It can spot exposure across many different chains. This is vital because many platforms accept tainted liquidity without realizing it. This often happens weeks or months after the original hack. You need a way to look back at the history of every address that interacts with your smart contracts.

Navigating the Shift: Regulatory Accountability in a Permissionless World

The Shift in Regulatory Focus

Regulators are not just looking at big companies like Coinbase anymore. They now watch how decentralized systems handle risky money. This makes DeFi risk management a must-have for any serious project. It is not an extra feature for later.

Reports show that regulators now look at how money moves. They do not just look at platform names. This is a big change. Just saying your project is decentralized will not protect you. If stolen money moves through your pools, you might be held responsible. You need to show you are trying to stop bad actors from using your system.

Phalcon Compliance 3.1 Available Now - your Guide to On-Chain Compliance

Illicit Activity and the Problem of Permissionless Access

Permissionless access is one of the best things about DeFi. It lets anyone in the world use financial tools. However, it also means that illicit actors can use those same tools. Scam proceeds and ransomware payments move through decentralized systems every day.

In many cases, DeFi risk appears indirectly. Your protocol might not talk to a criminal directly. But a criminal might send money to a liquidity pool that you use. We call this hopping. A bad actor can move money through five different wallets before it reaches you.

This indirect exposure is very dangerous because it is easy to miss. The funds might look clean on the surface. But they carry hidden risk from earlier steps in the chain. Traditional tools for banks cannot find this risk. They look for names and IDs. In DeFi, we only have addresses. You need tools that look at the behavior of the address itself.

Understanding On-Chain Behavior Patterns

To manage DeFi risk, we have to look for specific patterns. We need to ask questions about the addresses that use our protocols. Does this address interact with mixers like Tornado Cash? Does it receive funds from a known bridge exploit?

Phalcon Compliance targets this on-chain behavior. It helps you find high-risk flows while keeping your project decentralized. This behavior-based model is exactly what regulators want to see today. It shows that you are being proactive. You are not just waiting for a list of sanctioned addresses from the government. You are finding the risk yourself based on how the money moves.

Navigating Structural Uncertainty

Regulatory uncertainty is a big DeFi risk that stays with us. Many projects do not have a clear main office or a single leader. This makes it hard for governments to know who to talk to. So, regulators focus on the parts they can reach, like your website and your governance tokens. If you run the website people use to get to a protocol, you are a target for regulators.

The U.S. Treasury’s DeFi Risk Review shows that without AML controls, decentralized systems can be misused. To protect yourself, you need to show you are stopping bad actors. For example, the FATF (Financial Action Task Force) has rules like the Travel Rule. This rule says that Virtual Asset Service Providers (VASPs) must share info about who sends and receives crypto.

Phalcon Compliance helps you meet these rules. It shows you are serious about stopping illegal money movement. Having real-time risk controls helps you build trust with big partners. It makes it easier for you to grow in a world that is becoming more regulated every day. We recommend that you read these regulatory reports to see what is coming next.

The Human and Market Factors: Managing Volatility and User-Driven Risks

Dealing with Market and Liquidity Volatility

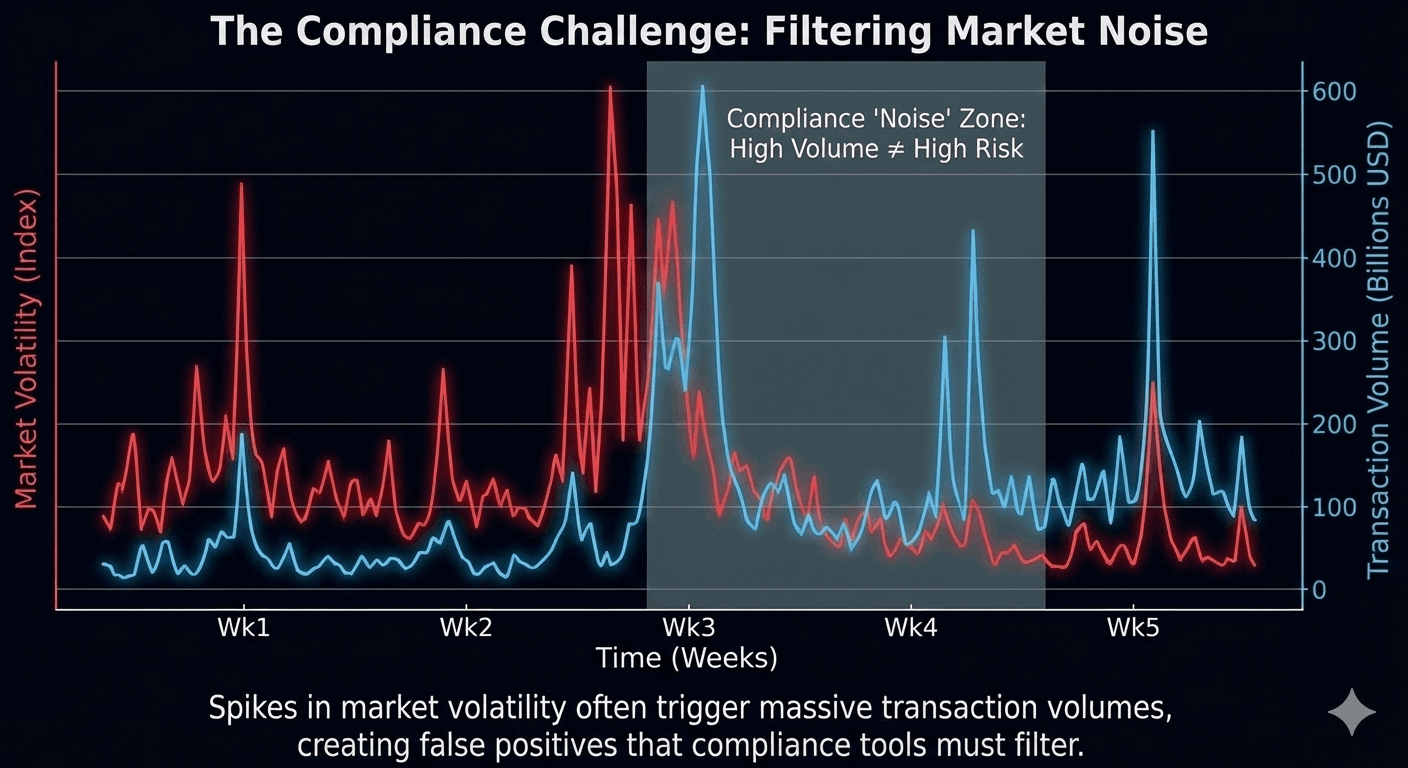

Not all DeFi risk comes from hackers. Sometimes, the market itself is the biggest risk. You know how fast prices can move in this industry. Sudden price drops can trigger massive liquidations and cause people to panic.

During a market crash, people often move money in unusual ways. This can look like suspicious activity to a basic compliance tool. If your tool is too simple, it might freeze honest users during a crisis. This is a bad user experience.

Advanced analytics can help you tell the difference between a panicked trader and a criminal. We look at the historical patterns of the user. We look at the context of the whole market. This reduces false positives. It keeps your protocol running smoothly even when the market is wild. This clarity is essential for keeping the trust of your liquidity providers.

The Human Element in DeFi Risk

User behavior is a source of DeFi risk that many people forget about. Most users are not experts. They might click a phishing link or approve a malicious smart contract by mistake. When a user is hacked, their stolen funds can flow into your protocol.

This creates a poison effect in your liquidity pools. If even a small part of your pool is stolen money, it can trigger red flags for your partners. As a builder, you have a responsibility to help your users stay safe. You can give them warnings if they are about to do something dangerous.

On-chain monitoring lets you see if a user's wallet has been compromised. You can see if they are sending funds from a suspicious source before they deposit into your protocol. This keeps your community safe and keeps your reputation clean. It is much better to stop the problem at the door than to try to fix it later.

Star Free Trials of Phalcon Compliance

The Future of Defense: Implementing Real-Time, Blockchain-Native Security

Why Old Tools Fail the DeFi Test

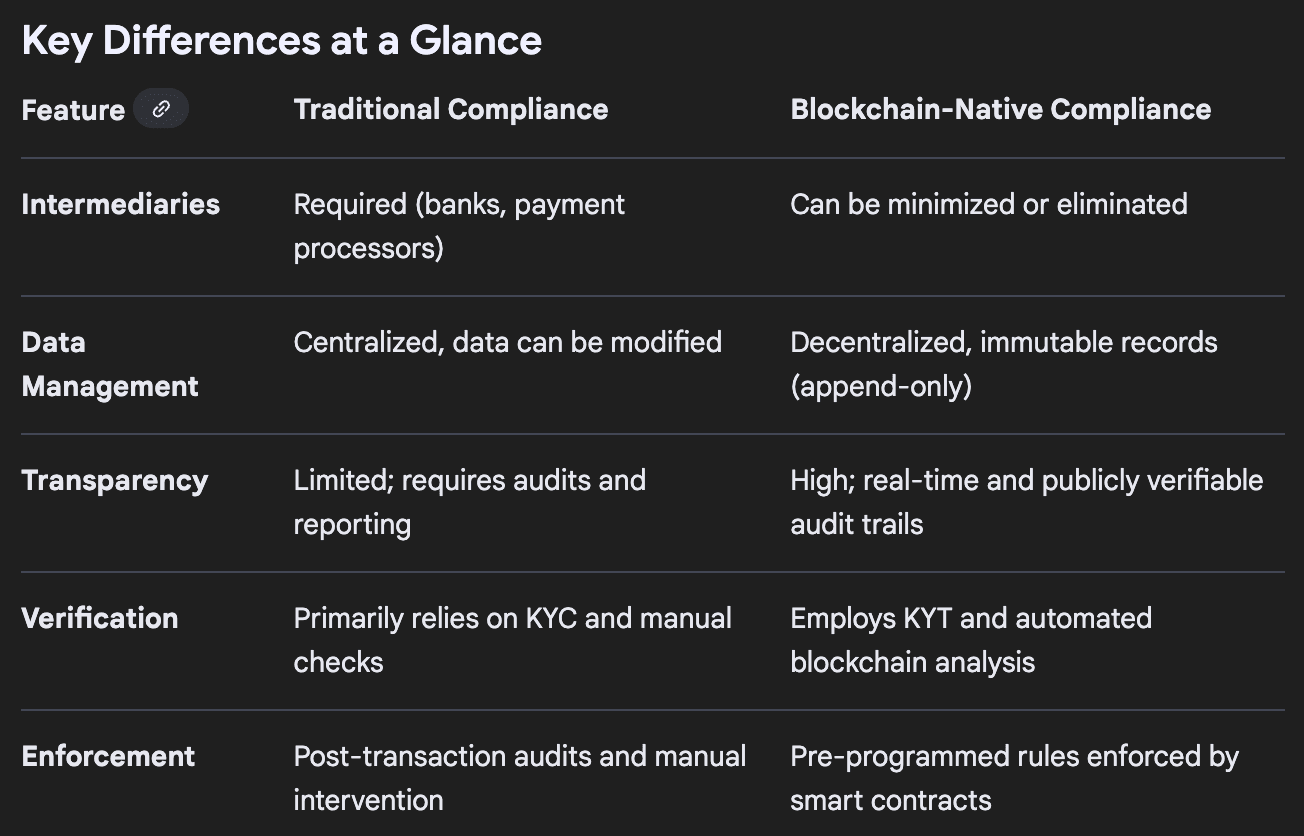

Most traditional compliance tools were made for banks. They assume that transactions take days to settle. They assume that everyone has an account with a name and a phone number. Blockchains break every one of these rules.

Transactions on a blockchain settle in seconds. There is no middleman to stop a transfer. This means you need a tool that works as fast as the blockchain itself. If your risk report comes out twenty-four hours after a hack, it is useless. The assets have already been laundered or obfuscated.

Another big problem is fragmentation. Many teams use one tool for sanctions and another tool for hack alerts. These tools do not talk to each other. This gives you a blurry picture of your DeFi risk. You need a single platform that brings all this data together in one place. You need to see the whole path of the money from the start to the finish.

The Power of Blockchain-Native Compliance

Managing DeFi risk does not mean you have to act like a bank. You do not need to ask for everyone's passport. You just need to look at the data on the chain. We call this Know Your Transaction (KYT).

Instead of asking who a person is, we look at where their money comes from. We look at what they have done on the chain before. This helps you find the bad actors without bothering honest users. Phalcon Compliance is built on this idea. It helps you stay safe.

This approach is great for modern DeFi. It keeps your project fast and open. But it also gives you the protection you need in a world with rules. It gives you the best of both worlds. It also helps VASPs meet rules like the FATF Travel Rule by giving clear data on transactions.

AI Agents and the Future of Risk

We are now entering a new age of DeFi. Operating at speeds far exceeding human capability, AI agents are increasingly managing trades and liquidity movement. They can execute thousands of trades in a single day.

In this new world, DeFi risk management must be automated. We cannot wait for a human to check a dashboard. Compliance data must be machine-readable. It must be available for AI agents to use in real time.

We are working on new models like agent-native compliance with X402. This means the risk checks are built directly into the automated workflows. Every transaction can have its own risk score that is calculated in milliseconds. This is the future of our industry. It will make the whole ecosystem much stronger and more resilient to attacks.

Conclusion: Building a Safer Future Together

DeFi risk is real, but you can manage it if you have the right tools. Smart contracts and illicit actors will always be a challenge. But you do not have to be afraid of them. You can use blockchain-native compliance to protect your protocol and your users.

The goal is to build lasting trust. You want your users to know that their money is safe with you. You want your partners to know that you are a serious project. Adopting real-time, behavior-based compliance is the best way to do this.

Teams around the world are using Phalcon Compliance to lower their DeFi risk. We invite you to join them. You can keep your project decentralized while making it much safer. The next phase of decentralized finance will belong to the projects that take risk seriously.

If you want to protect your protocol, you should take action now. Start by looking at your on-chain data. See where your funds are really coming from. When you understand your risk, you can master your future in DeFi.

Try the Self-Service Platform Now

FAQ

- What is the best way to identify DeFi risk in a new protocol?

The best way to identify DeFi risk is to look at both the protocol and the money flow.

You should check how the protocol connects to other protocols, bridges, and wallets. You should also track how funds move across chains. This helps you see real risk, not just what the protocol claims on the surface.

If risky funds can reach your protocol, the risk is real.

- Can real-time monitoring stop a DeFi risk from becoming a loss?

No, it cannot stop blockchain transactions directly.

But yes, it can reduce losses.

Real-time monitoring helps you spot risky activity early. When you see a threat fast, you can take action. You can pause contract features if possible. You can block wallet access in your app. You can warn users before they interact with risky addresses.

Fast signals lead to faster decisions. That is how losses are reduced.

- Is DeFi risk only about smart contract bugs?

No, it is not.

DeFi risk includes how people use your protocol. It also includes where the money comes from and where it goes. Sanctioned funds, stolen assets, and laundering behavior are real risks.

A code audit is important. But it cannot see money behavior on-chain. You need both code review and fund flow analysis.

- How do compliance companies help manage DeFi risk?

Compliance companies provide live on-chain data.

They show you where funds come from. They flag risky wallets and transactions. They give risk scores and labels you can act on.

This lets you automate checks instead of doing them by hand. It also helps you meet crypto compliance rules as you grow.

- Why is blockchain regulatory compliance important for DeFi risk?

Blockchain regulatory compliance sets clear rules for handling risk.

It helps you spot money laundering, fraud, and sanctions exposure early. It also helps you prove that you did your due diligence.

Staying compliant makes it easier to work with banks, partners, and regulators. It also builds trust with your users.