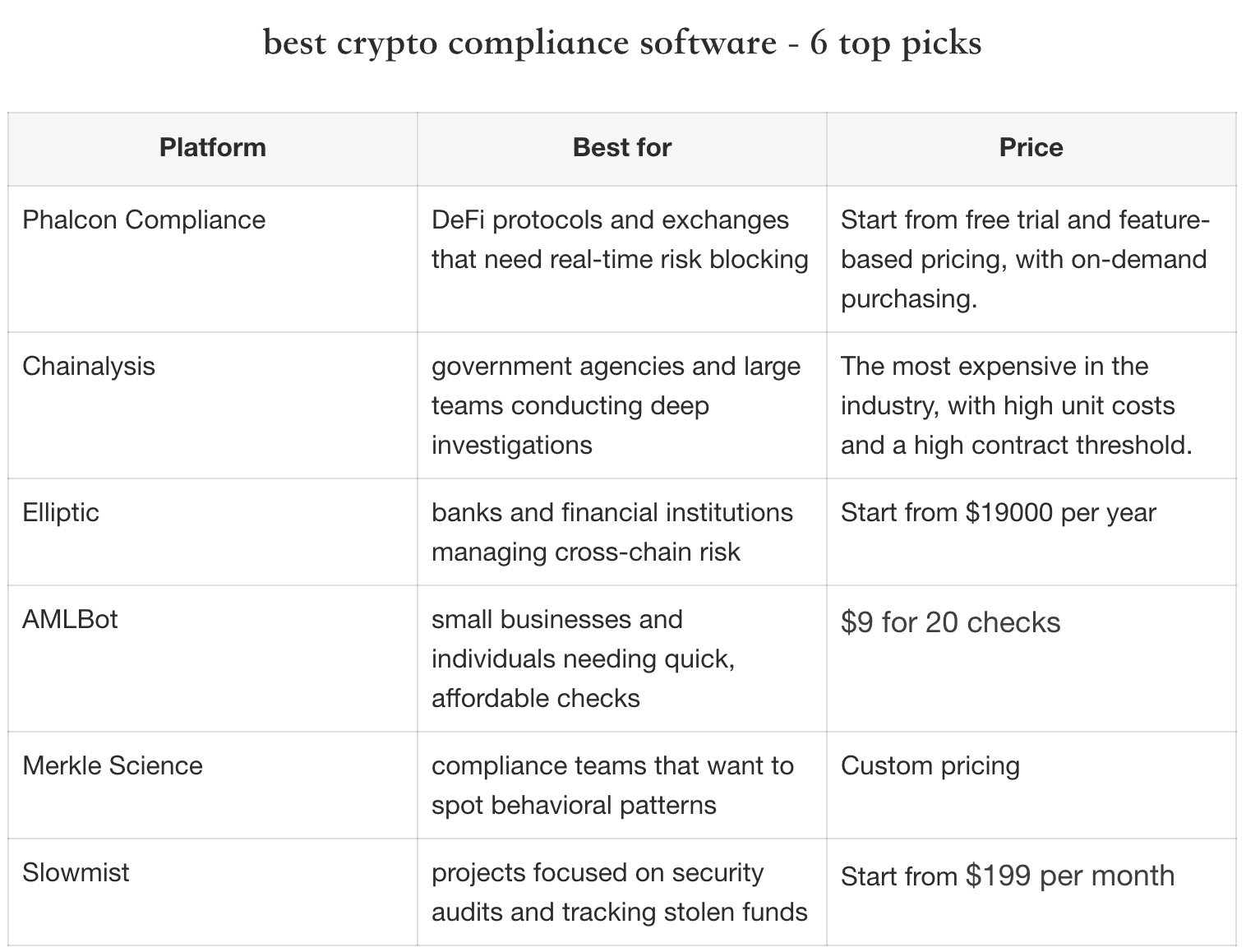

Crypto rules are a mess because every country has different laws. This creates a lot of risk for any crypto business. In 2024, sanctioned groups received a massive $16.2 billion in crypto. Any contact with this "dirty money" can lead to huge fines or lost bank accounts. It is vital to stop these funds before they cause trouble. That is why the best crypto compliance software is essential. We help track these risks automatically. This way, the business stays safe and ready to grow with confidence.

What You Need to Consider When Choosing Crypto Compliance Software

You might feel overwhelmed by all the options out there. However, the right choice depends on specific needs. Finding a tool that fits into the daily workflow is key.

First, speed is a critical factor. Some tools take a long time to scan a transaction. Fast exchanges or DeFi protocols cannot wait for slow reports. The software must provide answers in milliseconds. This helps you block bad transactions before they happen.

Second, checking the coverage is important. You might use many different blockchains like Ethereum, Solana, or Tron. It is vital to ensure the software supports every chain in use. If it misses one chain, you leave a door open for risk.

Finally, ease of use matters. Your team needs to understand the data quickly. A complex system that requires a PhD to read is not helpful. We also suggest looking for clear dashboards and good API support. This allows your developers to connect the tool directly without trouble.

6 Best Blockchain and Crypto Compliance Software Solutions

Picking the right partner is the best way to follow the law and protect your crypto business. Below, we look at the best crypto compliance software options that give you the power to stay legal and keep your operations safe.

1. Phalcon Compliance - best for DeFi protocols and exchanges that need real-time risk blocking

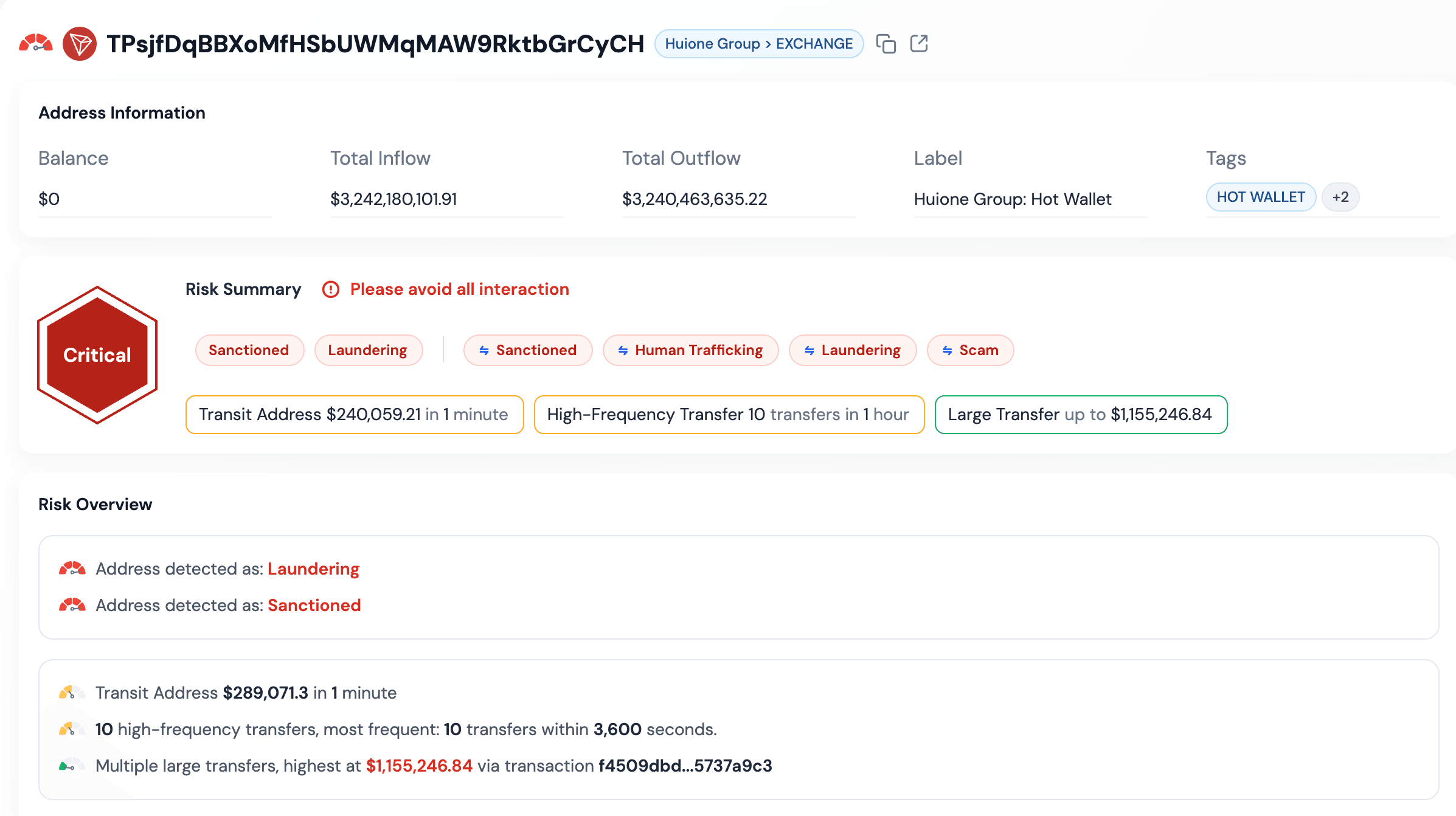

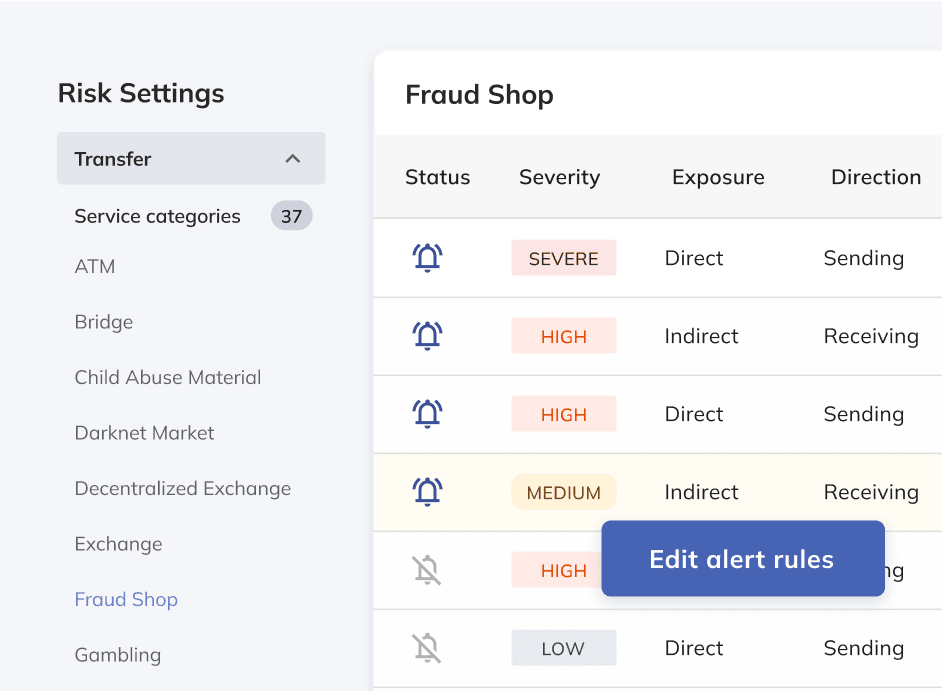

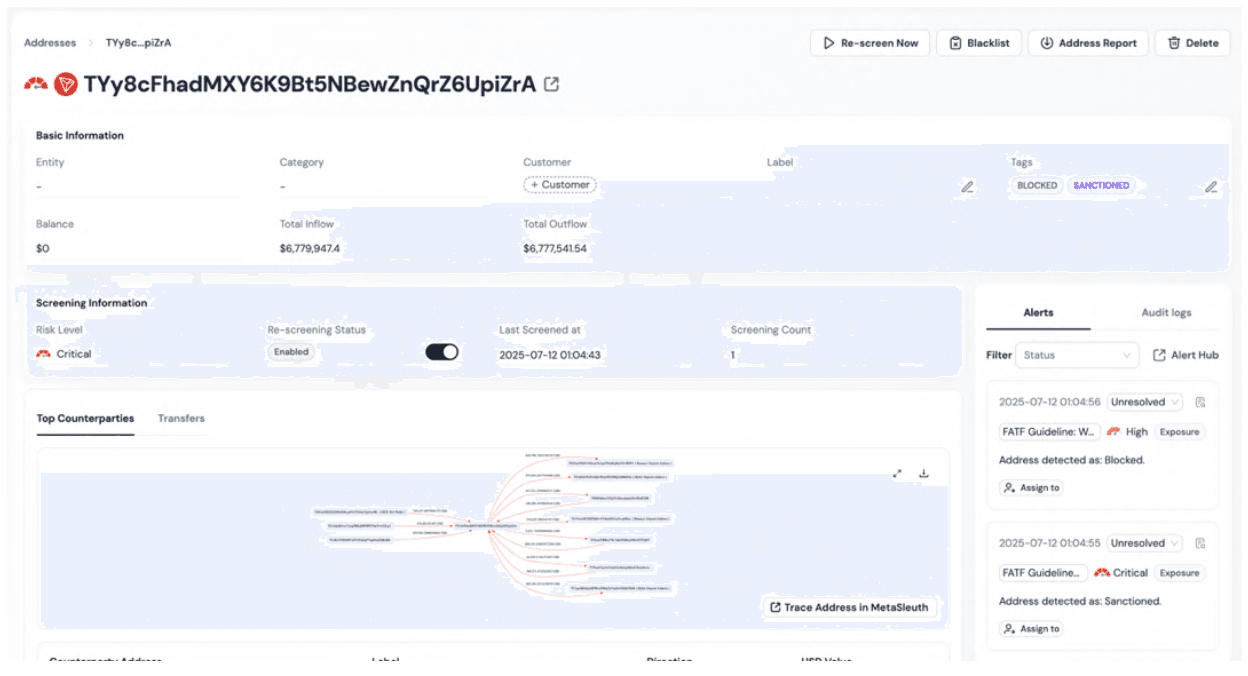

We put Phalcon Compliance at the top of our list for a simple reason. It changes how you handle risk. Most tools act like a history book. Most tools act like a history book and only report problems after the money is already gone. Phalcon is different because it acts like a shield. It sits right in your transaction flow to monitor activity while it is still pending. This makes it possible to block a hacker or a sanctioned wallet right away. The threat stops even before the transaction is complete.

The security experts at BlockSec designed it. Their background gives every user a major advantage. These experts fight hackers every day. They know exactly how criminals try to hide their tracks. Because of this, Phalcon sees threats that standard compliance tools often miss. The platform provides access to a massive database with more than 400 million address labels. This depth lets the system catch risky moves and suspicious trades as they happen.

There is no need to worry about slowing down users either. The system is incredibly fast. It returns a risk score in under 100 milliseconds. This speed lets you review each deposit or withdrawal. So, you avoid traffic jams on your platform. Your good users get a smooth experience while bad actors get stopped at the door.

We also love how flexible it is. It is easy to set custom risk rules to fit specific business needs. Developers also find the system very simple to use. The simple API allows your team to plug it into your system quickly. With 24/7 updates and instant alerts, no threat goes unnoticed. This helps you combat on-chain crime in over 50 countries. If you want to stop "dirty money" from ever entering your system, this is the tool you should use.

Key Features:

-

Real-time transaction monitoring and blocking

-

Over 400 million address labels

-

Instant risk scoring (under 100ms)

-

24/7 updates and instant alerts

-

Advanced Investigation Tools - MetaSleuth

-

STR Regulatory Reporting

Pros & Cons

-

Pros: It is extremely fast and works in real time. It catches security hacks along with compliance risks.

-

Cons: It is newer than some legacy competitors. It focuses heavily on technical on-chain behavior.

Pricing:

Start from free trial and feature-based pricing, with on-demand purchasing. Learn more about the pricing plan, please click here.

2. Chainalysis - best for government agencies and large teams conducting deep investigations

Chainalysis is likely a familiar name because they are the biggest player in the crypto world. They offer some of the best crypto compliance software available today. We often see them working with the FBI and other government groups to solve major crypto crimes. Their strength comes from their massive database. They've collected data for years. They know nearly every major entity on the blockchain. It uses this large database to connect blockchain transactions to real-world entities. This helps you identify criminal activities that might look normal on the surface.

If there is a need to look backward at a crime from years ago, these tools are a perfect fit. They have a product called "Reactor" that lets you visualize money moving like a map. Anyone can see funds hopping from one wallet to another in a clear graph. It provides powerful tracking tools to help you and your investigators solve crimes. You can block illicit funds and keep high compliance standards in any jurisdiction. It’s very powerful, but it works best for teams with dedicated analysts. They can spend hours exploring charts. It is built for deep research rather than just quick checks.

Key Features:

-

Extensive database linking crypto to real-world entities

-

"Reactor" tool for visual investigations

-

Powerful tracking tools for law enforcement

-

Global regulatory support and training

Pros & Cons

-

Pros: They have the largest dataset in the industry. They are highly trusted by regulators worldwide.

-

Cons: The price is very high for smaller teams. It can be slower to integrate for real-time checks.

Pricing:

The most expensive in the industry, with high unit costs and a high contract threshold.

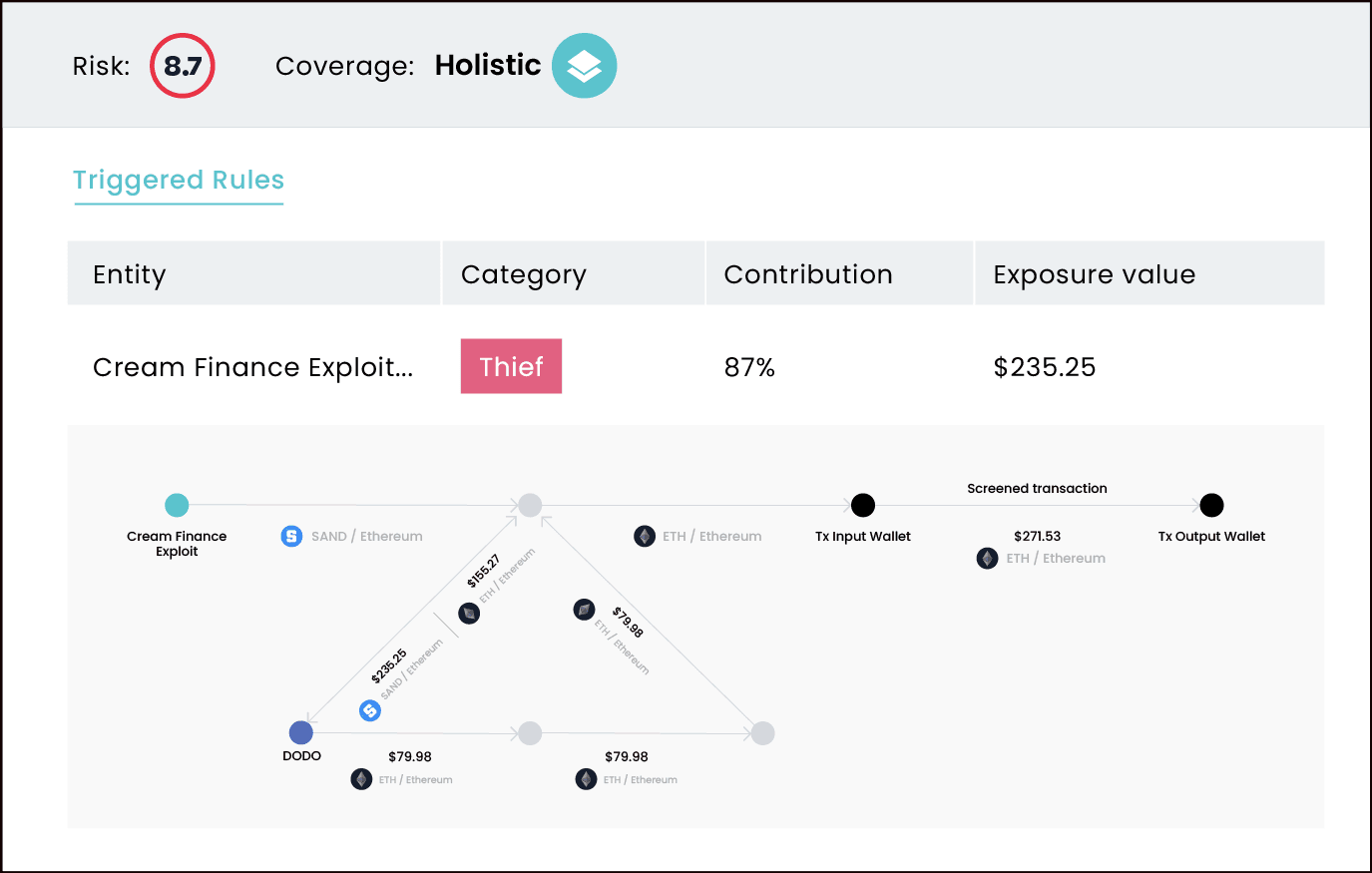

3. Elliptic - best for banks and financial institutions managing cross-chain risk

Elliptic is a renowned provider of blockchain analytics and compliance solutions. They help businesses meet rules and manage risks in cryptocurrency. We are impressed by how they handle "cross-chain" tracking. Criminals often hide their tracks by moving money across blockchains. For example, they might swap Bitcoin for Ethereum. Elliptic is very good at following these paths through a method they call "Holistic Screening." Instead of looking at just one asset, the system analyzes the whole wallet ecosystem.

Its tools offer clear insights into blockchain transactions. This helps ensure strong compliance and security for any firm. This makes them a great partner if you are a bank that wants to offer crypto services safely. They are fluent in traditional finance and guide you in meeting strict banking rules. Their software screens wallets and transactions to give you a clear risk score. You can see exactly where the funds came from and if they touched any sanctioned mixers. They also provide excellent training resources. If your team is new to crypto compliance, Elliptic helps you get up to speed quickly. It is a robust choice for institutions needing to check assets on different networks.

Key Features:

-

Holistic cross-chain investigations

-

Deep insights into blockchain transactions

-

Wallet screening for sanctions

-

Educational training for compliance teams

Pros & Cons

-

Pros: Excellent at tracking funds across different chains. It is very friendly for traditional banking needs.

-

Cons: The interface can be complex for beginners. It focuses more on enterprise needs than DeFi speed.

Pricing:

-

Starter Suite: $19000 per year

-

Growth Suite: $21000 per year

-

Enterprise Suite: Custom pricing based on specific business needs

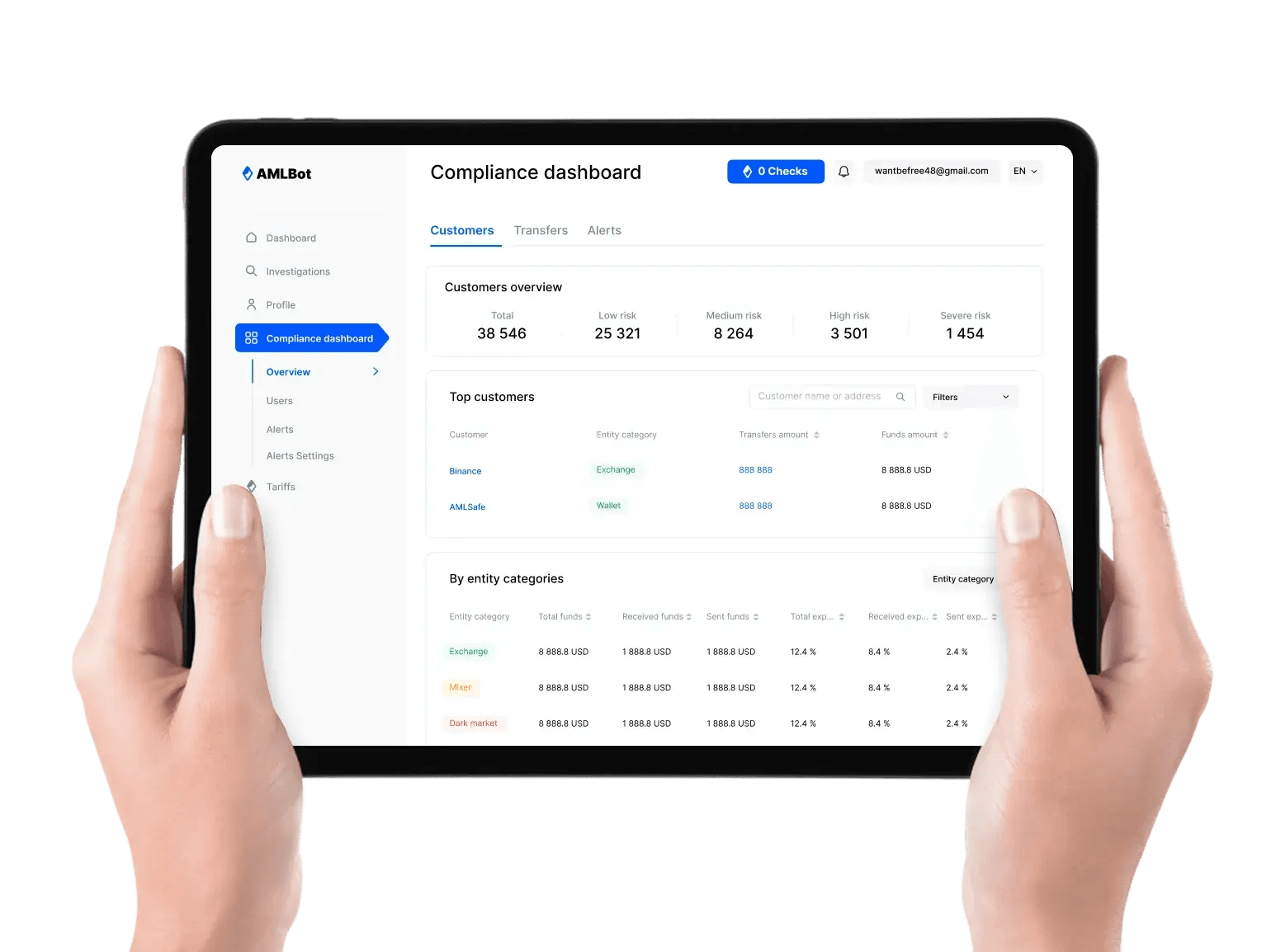

4. AMLBot KYT - best for small businesses and individuals needing quick, affordable checks

If there is a small budget or a new project starting out, AMLBot might be the right fit. It's an automated tool that monitors transactions. It's one of the top options for crypto compliance software. Unlike the big enterprise tools, there is no need to sign a massive contract or go through a long sales process. We love that you can access it directly through a Telegram bot. This makes it incredibly easy to use on your phone or laptop. It is perfect for peer-to-peer traders or small OTC desks that need to check wallets quickly.

The system spots and stops money laundering and terrorism financing risks before they hurt a business. The tool screens major blockchains and tokens in real time. This keeps businesses secure and compliant without requiring a huge team. You get a simple risk report that tells you if a wallet is clean or dirty. You also have the option to pay only for what you use. This "pay-as-you-go" model is great if you do not have a high volume of transactions. It democratizes compliance by making professional screening tools available to everyone. You can set it up in minutes and start checking risks immediately.

Key Features:

-

Automated transaction monitoring

-

Screens major blockchains in real time

-

Pay-as-you-go pricing model

-

Easy access via Telegram or web

Pros & Cons

-

Pros: It is very affordable and easy to start. You do not need a long sales process.

-

Cons: It lacks the deep investigation tools of larger platforms. It is not suitable for high-volume automated trading.

Pricing:

-

Lite: $9 for 20 checks

-

Pro: $350 for 1000 checks

-

Pro+: $3750 for 15000 checks

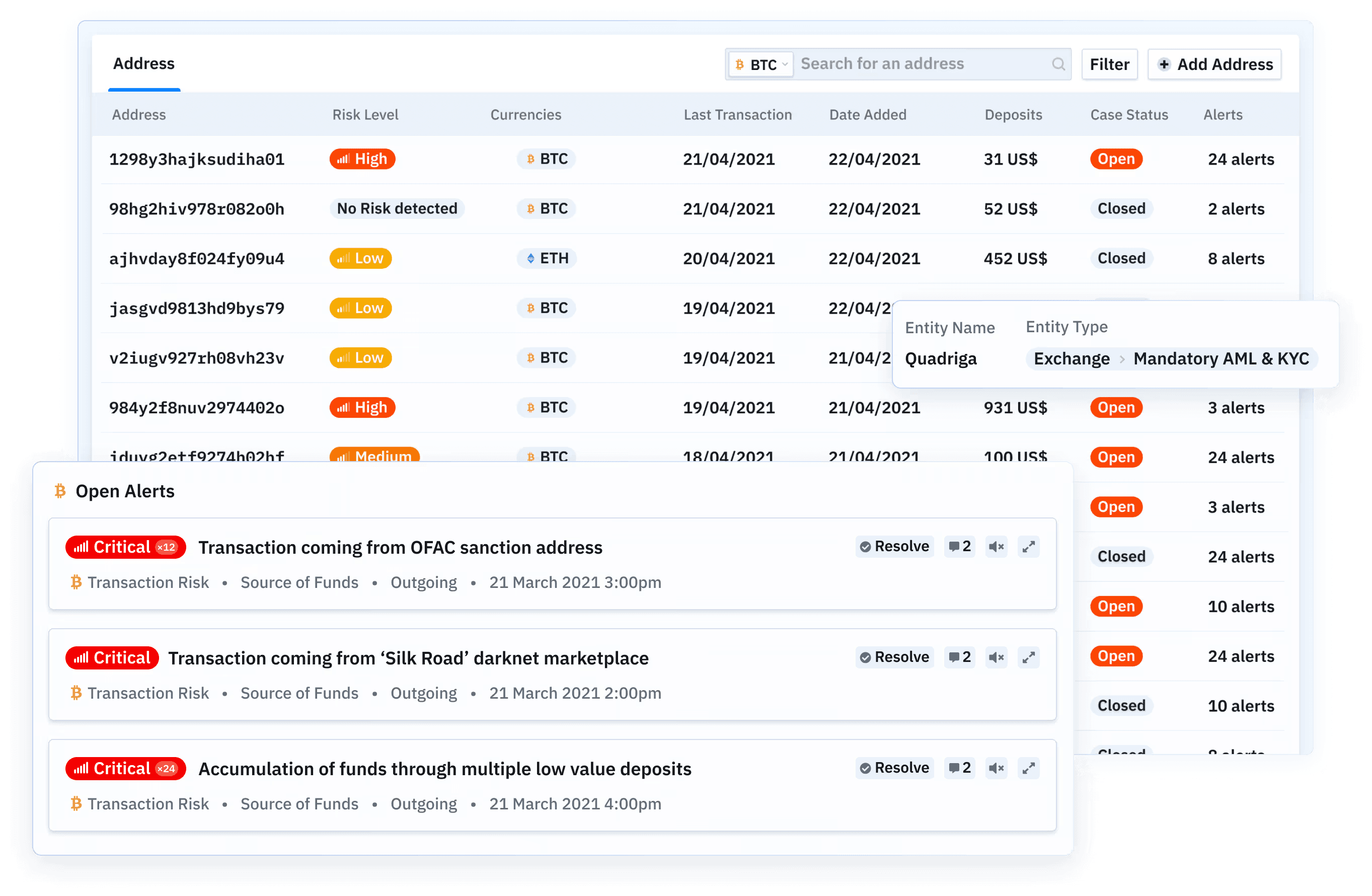

5. Merkle Science - best for compliance teams that want to spot behavioral patterns

Merkle Science is a cutting-edge platform for monitoring cryptocurrencies. It provides excellent compliance software for the crypto market by taking a smarter approach than many other tools. Most software just checks if a wallet is on a "bad list." But what if the hacker uses a brand new wallet? That is where Merkle Science shines. It combines blacklists with behavior-based analytics. Their system looks at how a wallet acts to decide if it is dangerous. If a user starts moving money like a criminal, the software flags it even if the address is not on any blacklist yet.

This ability helps businesses find illegal activities they might overlook with regular tools. It also helps them manage regulatory risks better by adapting to new threats. It is possible to customize the rules to fit specific business needs. If there is a need to be extra careful about high-value deposits, a special rule can be set for that. This flexibility is very useful for compliance teams that want more control. Their "Compass" tool helps you manage all these rules in one place. It allows for automated reporting and tracks risks as they evolve. If you want to catch criminals before the official lists update, this behavioral approach is a strong advantage.

Key Features:

-

Combines blacklists with behavior-based analytics

-

Customizable risk rules

-

Predictive analysis for new threats

-

"Compass" tool for transaction monitoring

Pros & Cons

-

Pros: It can catch new criminals before they are listed. You can customize the rules to fit your business.

-

Cons: Predictive models can sometimes give false alarms. It requires some tuning to get it right.

Pricing:

-

1,000 Annual Screenings: Ample coverage for your needs

-

Unlimited Rescreening: Refresh your data without limit

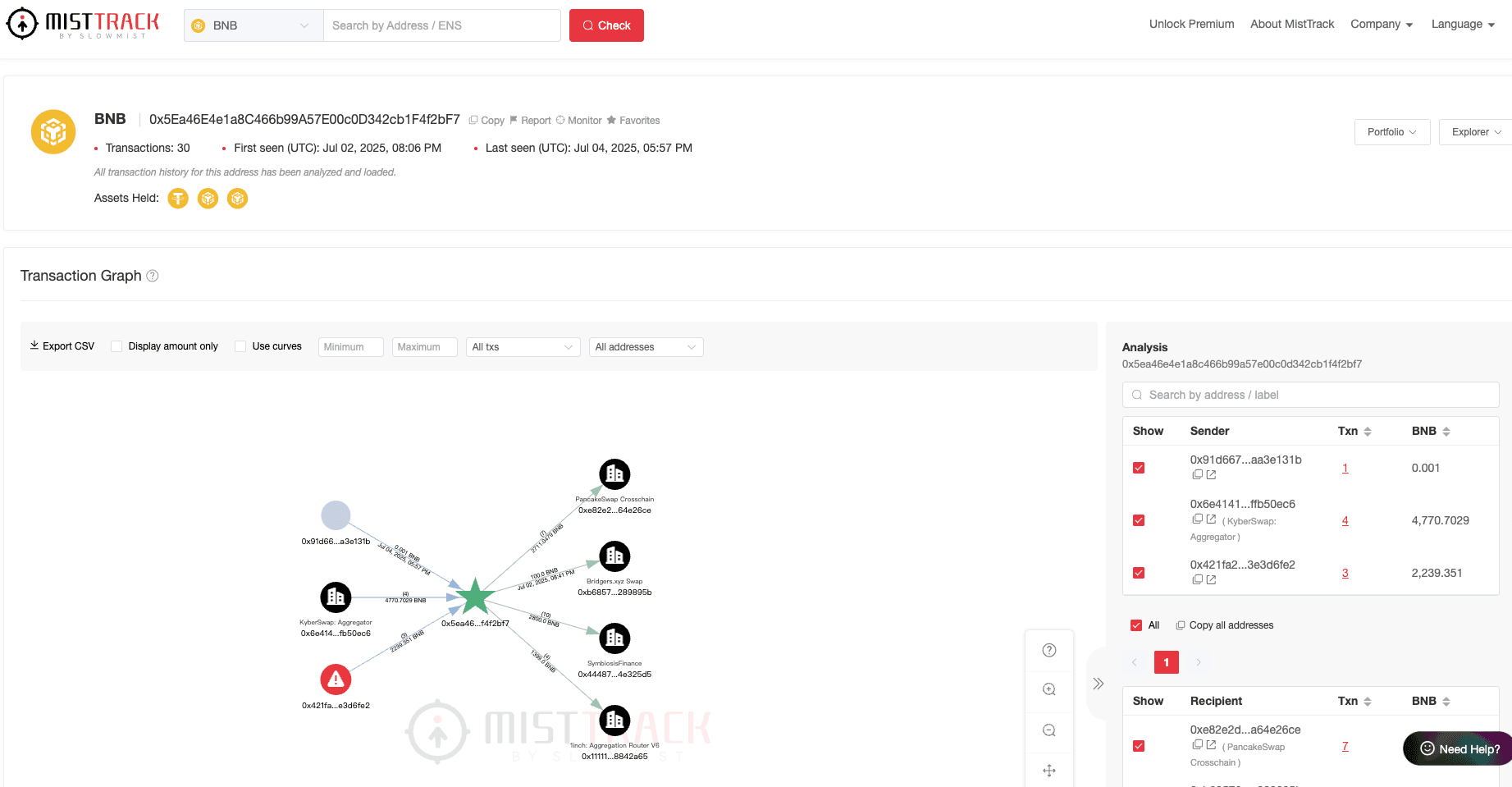

6. Slowmist - best for projects focused on security audits and tracking stolen funds

SlowMist is famous for its deep security audits, and the team combined that knowledge to develop MistTrack. This leading AML tool is a perfect choice if there is a need to understand exactly who is behind a transaction. While other tools simply give a "pass" or "fail," MistTrack acts like a detective. It helps you see the full story behind every wallet address.

The database behind this tool is massive. It holds over 300 million address tags and identifies more than 90 million risky addresses. This means the system can spot money laundering risks that standard lists might miss. The "AML Risk Score" is a great feature. It looks at the history of a wallet and its relationships to calculate a simple risk number for you. If a user sends funds that passed through a mixer five steps ago, MistTrack will see it.

This tool is also incredibly easy to use for daily compliance tasks. The dashboard makes it simple to visualize exactly how money moves between wallets. It draws a clear map of funds so you can prove the "Source of Funds" to regulators. There is also a feature called "Know Your Transaction" (KYT). This monitors a project 24/7 and sends an alert if a risky interaction happens. For anyone running a crypto fund or an exchange, this helps with staying compliant without a huge team of analysts. You get the power of a top-tier security lab wrapped in a simple compliance tool.

Key Features:

-

Real-time KYT (Know Your Transaction) monitoring

-

Database with over 300 million address tags

-

Visual dashboard for tracing fund flows

Pros & Cons

-

Pros: The malicious address library is one of the best in the world because it comes from real security incidents. The visual tracking tools make complex investigations very easy to understand.

-

Cons: It is very powerful for investigations and tracking but might require more manual attention than fully automated blocking tools. It is heavily focused on on-chain data analysis.

Pricing:

-

Basic: $199 per month

-

Standard: $599 per month

-

Compliance: $1799 per month

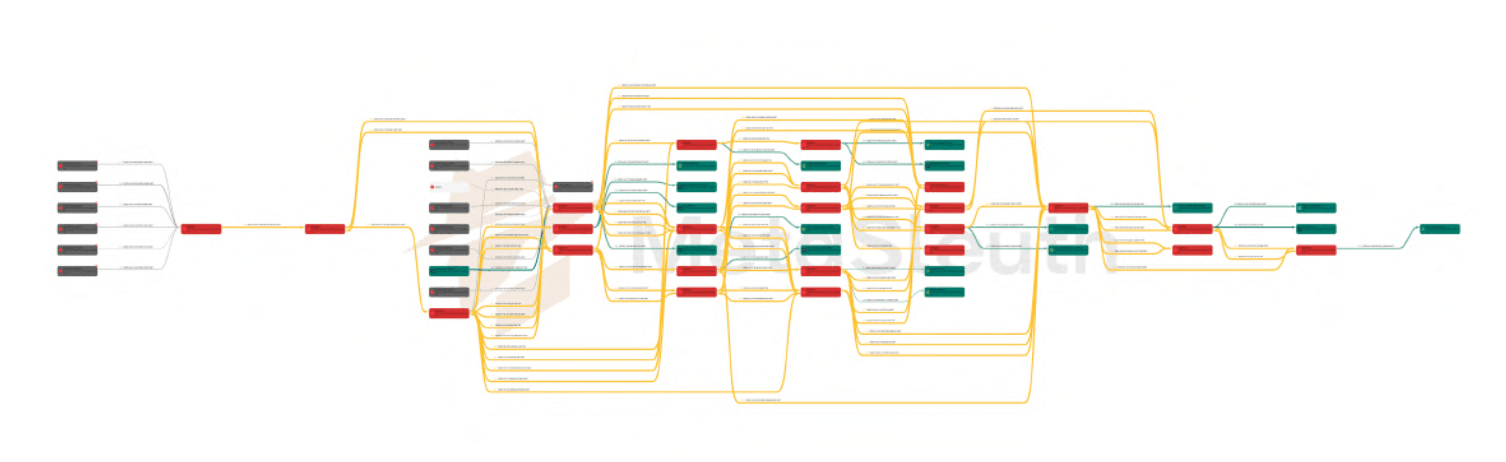

Case Study: Israel–Iran Conflict Fundraising

Between June 13–30, 2025, amid heightened hostilities between Israel and Iran, Tether froze 151 addresses. We analyzed administrative seizure orders issued by Israel’s National Bureau for Counter Terror Financing (NBCTF), using them as a representative sample to assess terrorist-linked USDT transactions.

-

Timing: Only one new seizure order was issued after the June 13 escalation, dated June 26. The prior order was from June 8, indicating a delay in enforcement during geopolitical tensions.

-

Targeted Organizations: Since October 7, 2024, NBCTF issued eight orders—four of which explicitly mention Hamas; the latest names Iran for the first time.

-

Assets Seized:

- 76 USDT (TRON) addresses

- 16 Bitcoin addresses

- 2 Ethereum addresses

- 641 Binance accounts

- 8 OKX accounts

Using MetaSleuth, BlockSec’s on-chain investigation platform, we traced fund sources and destinations. We found that some exchanges appeared at both ends of the transaction graph—as sources (via hot wallets) and destinations (via deposit addresses)—highlighting their central role in the laundering process.

Want to learn more about crypto compliance? Check out the typologies of on-chain illicit funds. Click here to download Crypto Payment Compliance Handbook for free!

Compliance Alert

Weak execution of AML/CFT protocols and delays in asset freezes may allow illicit transfers to occur before enforcement actions take effect. We recommend stronger mechanisms for monitoring, detection, and interdiction to proactively mitigate these risks. All addresses in this case have already been flagged by Phalcon Compliance, our compliance monitoring product.

Why Crypto Compliance Matters for Success

Using the best crypto compliance software is not just about following rules. It is a smart move for your business growth. Here is why it is so valuable:

-

Stay Away from Legal Trouble: With $16.2 billion in sanctioned funds moving around, the risks are real. Good compliance acts as your shield. It helps avoid huge fines and keeps a business from being shut down by the government.

-

Build Real Trust: Trust is everything in Web3. When a platform shows that it checks for "dirty money," users and partners feel safe. This makes it easier to get more customers and better business deals.

-

Open Doors to Traditional Banks: Many banks are afraid of crypto. However, a strong AML system makes them more likely to work with a project. This makes it much easier to handle fiat money and grow globally.

-

Fight Global Crime: Stopping money for terrorism or human trafficking is good for the world. You are helping to make the crypto space a cleaner and safer place for everyone.

-

Turn Risk into Advantage: In a world with messy rules, being compliant makes you a leader. It gives a "green light" to enter new markets while others are still stuck in the "compliance fog."

Conclusion

Choosing the best crypto compliance software is a big decision. There is a need to balance safety, speed, and cost.

For the best protection for any platform, we suggest Phalcon Compliance. It is the only tool that combines deep security with real-time speed. It helps you block risks instantly, which is vital for modern crypto businesses.

For teams that need to dig into deep investigations or work with law enforcement, Chainalysis is also a solid option.

Phalcon Compliance gives businesses the best blend of technology and practical use. It helps them stay safe and grow smoothly. The right choice is the tool that helps you sleep well at night while the business keeps moving.

Ready to secure your platform’s future? Experience the power of Phalcon Compliance for free and start your regulatory journey today.

Frequently Asked Questions (FAQ)

- Is crypto compliance only for big exchanges, or do startups need it too?

Crypto compliance is for both big exchanges and startups. If you touch "dirty money" by mistake, you could lose your bank account or face legal trouble instantly. Many crypto compliance services have flexible plans. You can start small and stay safe without spending too much.

- Why can’t I manually check a wallet address on a block explorer?

You could, but it’s impossible to keep up. Hackers move money through thousands of wallets in seconds. Blockchain compliance companies have automated tools that trace these hidden paths instantly. A human eye simply cannot see what their software sees.

- Will using compliance software slow down my users' transactions?

No. Modern tools are built for speed. They run in the background and check transactions in milliseconds. Users won’t see it, but your platform will automatically block risky wallets. This keeps everyone safe.

- Can these services help me get a bank account for my crypto business?

Yes, this is one of the biggest benefits. Traditional banks are scared of crypto risks. Show them reports from trusted crypto compliance services. This shows you are a responsible business. It acts like a "trust badge" that banks respect.

- Do I need to hire a team of lawyers to run this software?

No, not necessarily. The best software is designed to be user-friendly. It gives you clear "Red Light" or "Green Light" signals. While lawyers help with big decisions, your daily operations team can easily handle the dashboard provided by blockchain compliance companies.

- What happens if the laws change tomorrow? Do I need to update the code?

No, you don’t have to change your code. That is the best part about using a cloud-based service. The providers update their databases and rules automatically whenever regulations change. The crypto compliance services take care of the legal stuff for you.

- Does compliance software violate my users' privacy?

No, it doesn't. It strikes a balance. These tools mainly look at "on-chain" data. This data is public and available on the blockchain. They focus on crime patterns, like money laundering, not on reading your users' personal emails. It’s about stopping bad money, not spying on good people.

- How do I choose between different blockchain compliance companies?

Look for "Chain Coverage." Some companies only track Bitcoin and Ethereum. If you are building on a newer chain (like Solana or Base), make sure the provider actually supports it. Also, check if they offer real-time API support, which is crucial for DeFi apps.

- Can this software stop 100% of all hacks and scams?

No tool is perfect. However, crypto compliance services reduce your risk to a great extent. They’re like a smoke detector. They may not stop every fire, but they alert you early. This helps keep your whole house safe.

- What is the difference between "KYC" and "Transaction Monitoring"?

KYC (Know Your Customer) is checking an ID card to see who someone is. Transaction Monitoring is checking what they are doing. Blockchain compliance companies focus on the second part. They ensure that the funds on your platform aren't tied to darknet markets or sanctions.